INDEPENDENT AUDITOR’S REPORT

Report on the Audit of the Consolidated Financial Statements

Opinion

We have audited the consolidated financial statements of Vodafone Qatar P.Q.S.C (the “Company”), and its subsidiary (together the “Group”), which comprise the consolidated statement of financial position as at December 31, 2019, and the consolidated statement of income, consolidated statement of comprehensive income, consolidated statement of changes in equity and consolidated statement of cash flows for the year then ended, and notes to the consolidated financial statements, including a summary of significant accounting policies.

In our opinion, the accompanying consolidated financial statements present fairly, in all material respects, the consolidated financial position of the Group as at December 31, 2019, and its consolidated financial performance and its consolidated cash flows for the year then ended in accordance with International Financial Reporting Standards (IFRSs).

Basis for Opinion

We conducted our audit in accordance with International Standards on Auditing (ISAs). Our responsibilities under those standards are further described in the Auditor’s Responsibilities for the Audit of the Consolidated Financial Statements section of our report. We are independent of the Group in accordance with the International Ethics Standards Board for Accountants’ Code of Ethics for Professional Accountants (IESBA Code) together with the other ethical requirements that are relevant to our audit of the Group’s consolidated financial statements in the State of Qatar, and we have fulfilled our other responsibilities under those ethical requirements. We believe that the audit evidence we have obtained is sufficient and appropriate to provide a basis for our opinion.

Key Audit Matters

Key audit matters are those matters that, in our professional judgment, were of most significance in our audit of the consolidated financial statements of the current year. These matters were addressed in the context of our audit of the consolidated financial statements as a whole, and in forming our opinion thereon, and we do not provide a separate opinion on these matters.

Key audit matters

Accuracy of revenue recognition and controls around IT subsystems

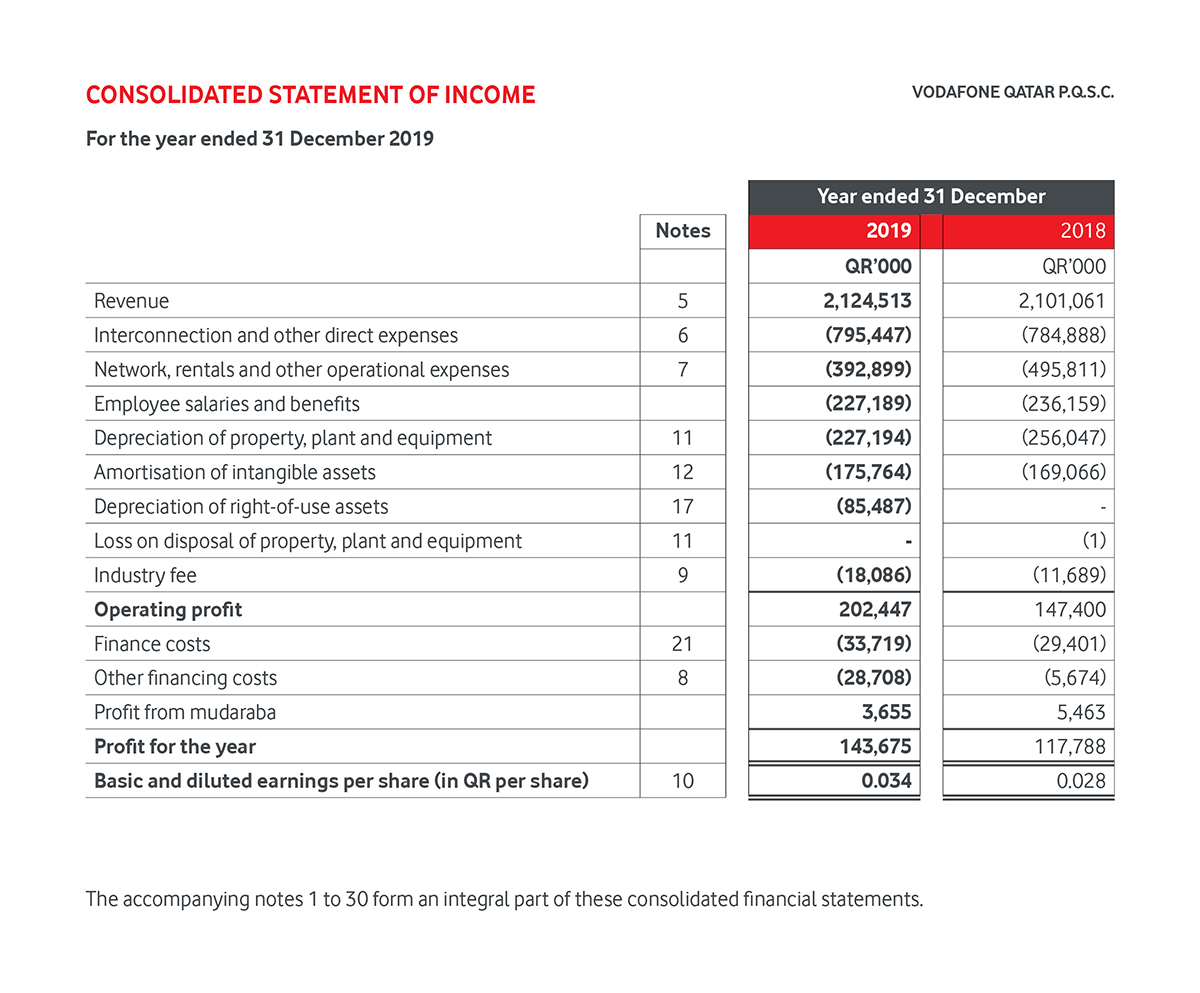

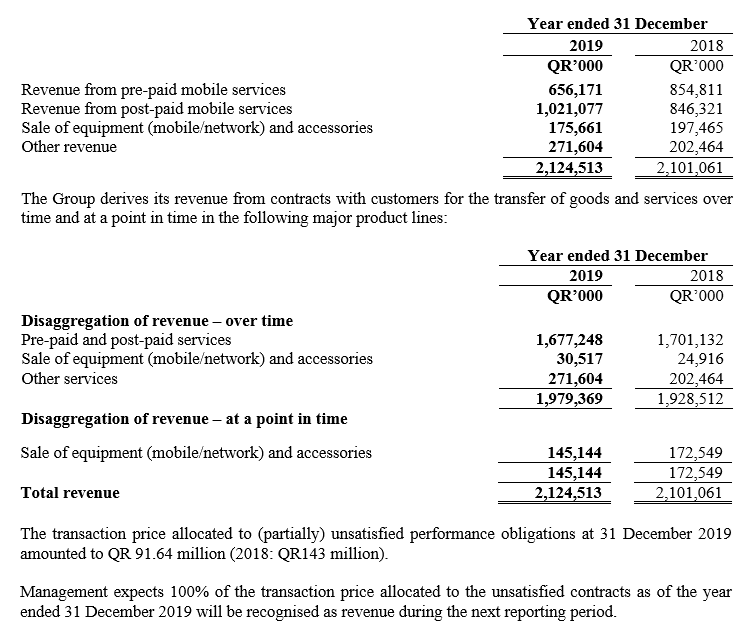

The Group reported revenue of QR. [2,124,513] thousand from telecommunication and related activities.

There is an inherent risk around the accuracy of revenue recognised given the complexity of the systems and business products and services. Complex IT systems are used in processing large volume of data through a number of different systems and consequently this matter has been identified as a key audit matter

The following notes to the consolidated financial statements contain the relevant information related to the above discussed matters:

Note 3 – Significant Accounting Policies

Note 5 – Revenue

Note 27 – Critical Accounting Judgments and Key Sources of Estimation Uncertainty

How our audit addressed the key audit matters

Our audit approach included a combination of test of controls and substantive procedures, in particular, the following:

- Understanding the significant revenue processes and identifying the relevant controls, IT systems, interfaces and reports;

- Understanding the control environment and testing the general IT controls over the main systems and applications involved in the revenue recording process. In doing so, we involved our IT specialists to assist in the audit of IT system controls.

- Evaluating the design and implementation and testing the operating effectiveness of automated controls in the IT environment in which the core network and related systems reside, covering pervasive IT risks around access security, change management, data centre and network operations;

- Performing substantive audit procedures on significant revenue streams including analytical procedures, reconciliation procedures and/ or test on the accuracy of customer bills on a sample basis, as applicable;

- Assessing the appropriateness of the Group’s accounting policy and the compliance of revenue recognized therewith; and

- Assessing the overall presentation, structure and content of revenue related disclosures in notes [3], [5] and [27] to the consolidated financial statements to determine if they were in compliance with the requirements of IFRS

Other Information

Management is responsible for the other information. The other information comprises the Board of Directors’ report, but does not include the consolidated financial statements and our auditor’s report thereon, which we obtained prior to the date of this auditor’s report, and the Annual Report, which is expected to be made available to us after that date.

Our opinion on the consolidated financial statements does not cover the other information and we do not and will not express any form of assurance conclusion thereon.

In connection with our audit of the consolidated financial statements, our responsibility is to read the other information identified above and, in doing so, consider whether the other information is materially inconsistent with the consolidated financial statements or our knowledge obtained in the audit, or otherwise appears to be materially misstated.

If, based on the work we have performed on the other information that we obtained prior to the date of this auditor’s report, we conclude that there is a material misstatement of this other information, we are required to report that fact. We have nothing to report in this regard.

When we read the Annual Report, if we conclude that there is a material misstatement therein, we are required to communicate the matter to those charged with governance.

Responsibilities of Management and Those Charged with Governance for the Consolidated Financial Statements

Management is responsible for the preparation and fair presentation of the consolidated financial statements in accordance with IFRSs and applicable provisions of Qatar Commercial Companies Law, and the Company’s Articles of Association, and for such internal control as management determines is necessary to enable the preparation of consolidated financial statements that are free from material misstatement, whether due to fraud or error.

In preparing the consolidated financial statements, management is responsible for assessing the Group’s ability to continue as a going concern, disclosing, as applicable, matters related to going concern and using the going concern basis of accounting unless management either intends to liquidate the Group or to cease operations, or has no realistic alternative but to do so.

Those charged with governance are responsible for overseeing the Group’s financial reporting process.

Auditor’s Responsibilities for the Audit of the Consolidated Financial Statements

Our objectives are to obtain reasonable assurance about whether the consolidated financial statements as a whole are free from material misstatement, whether due to fraud or error, and to issue an auditor’s report that includes our opinion. Reasonable assurance is a high level of assurance, but is not a guarantee that an audit conducted in accordance with ISAs will always detect a material misstatement when it exists. Misstatements can arise from fraud or error and are considered material if, individually or in the aggregate, they could reasonably be expected to influence the economic decisions of users taken on the basis of these consolidated financial statements.

As part of an audit in accordance with ISAs, we exercise professional judgment and maintain professional skepticism throughout the audit. We also:

- Identify and assess the risks of material misstatement of the consolidated financial statements, whether due to fraud or error, design and perform audit procedures responsive to those risk, and obtain audit evidence that is sufficient and appropriate to provide a basis for our opinion. The risk of not detecting a material misstatement resulting from fraud is higher than the one resulting from error, as fraud may involve collusion, forgery, intentional omission, misrepresentations, or the override of internal control.

- Obtain an understanding of internal control relevant to the audit in order to design audit procedures that are appropriate in the circumstances, but not for the purpose of expressing an opinion on the effectiveness of the internal controls.

- Evaluate the appropriateness of accounting policies used and the reasonableness of accounting estimates and related disclosures made by management.

- Conclude on the appropriateness of management’s use of the going concern basis of accounting and, based on the audit evidence obtained, whether a material uncertainty exists related to events or conditions that may cast significant doubt on the Group’s ability to continue as a going concern. If we conclude that a material uncertainty exists, we are required to draw attention in our auditor’s report to the related disclosures in the consolidated financial statements or, if such disclosures are inadequate, to modify our opinion. Our conclusions are based on the audit evidence obtained up to the date of our auditor’s report. However, future events or conditions may cause the Group to cease to continue as a going concern.

- Evaluate the overall presentation, structure and content of the consolidated financial statements, including the disclosures, and whether the consolidated financial statements represent the underlying transactions and events in a manner that achieves fair presentation.

- Obtain sufficient appropriate audit evidence regarding the financial information of the entities or business activities within the Group to express an opinion on the consolidated financial statements. We are responsible for the direction, supervision and performance of the group audit. We remain solely responsible for our audit opinion.

We communicate with those charged with governance regarding, among other matters, the planned scope and timing of the audit and significant audit findings, including any significant deficiencies in internal control that we identify during our audit.

We also provide those charged with governance with a statement that we have complied with relevant ethical requirements regarding independence, and to communicate with them all relationships and other matters that may reasonably be thought to bear on our independence, and where applicable, related safeguards.

From the matters communicated with those charged with governance, we determine those matters that were of most significance in the audit of the consolidated financial statements of the current year and are therefore the key audit matters. We describe these matters in our auditor’s report unless law and regulations preclude public disclosure about the matter or when, in extremely rare circumstances, we determine that a matter should not be communicated in our report because the adverse consequences of doing so would reasonably be expected to outweigh the public interest benefits of such communication.

Report on Other Legal and Regulatory Requirements

Further, as required by the Qatar Commercial Companies Law, we report the following:

- We are of the opinion that proper books of account were maintained by the Group, physical inventory verification has been duly carried out and the contents of the director’s report are in agreement with the Group’s financial statements.

- We obtained all the information and explanations which we considered necessary for our audit.

- To the best of our knowledge and belief and according to the information given to us, no contraventions of the applicable provisions of Qatar Commercial Companies Law and the Company’s Articles of Associations were committed during the year which would materially affect the Group’s consolidated financial position or its consolidated financial performance.

For Deloitte & Touche Qatar Branch

Walid Slim

Partner

License No. 319

QFMA Auditor License No. 120156

Statement of Income

STATEMENT OF INCOME

For the year ended 31 December 2019

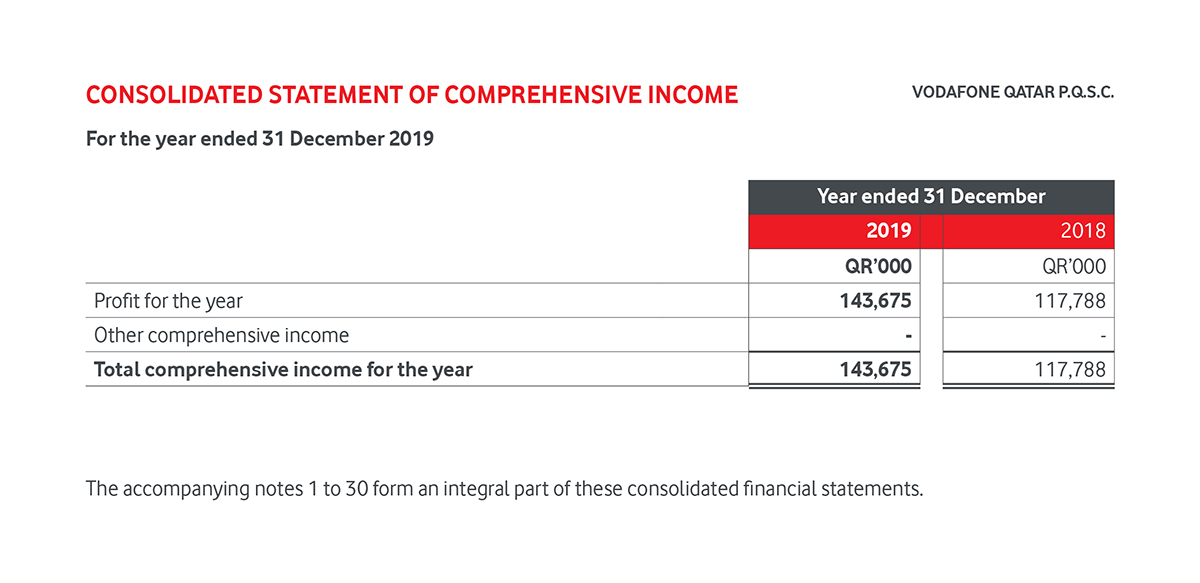

Statement of Comprehensive Income

STATEMENT OF COMPREHENSIVE INCOME

For the year ended 31 December 2019

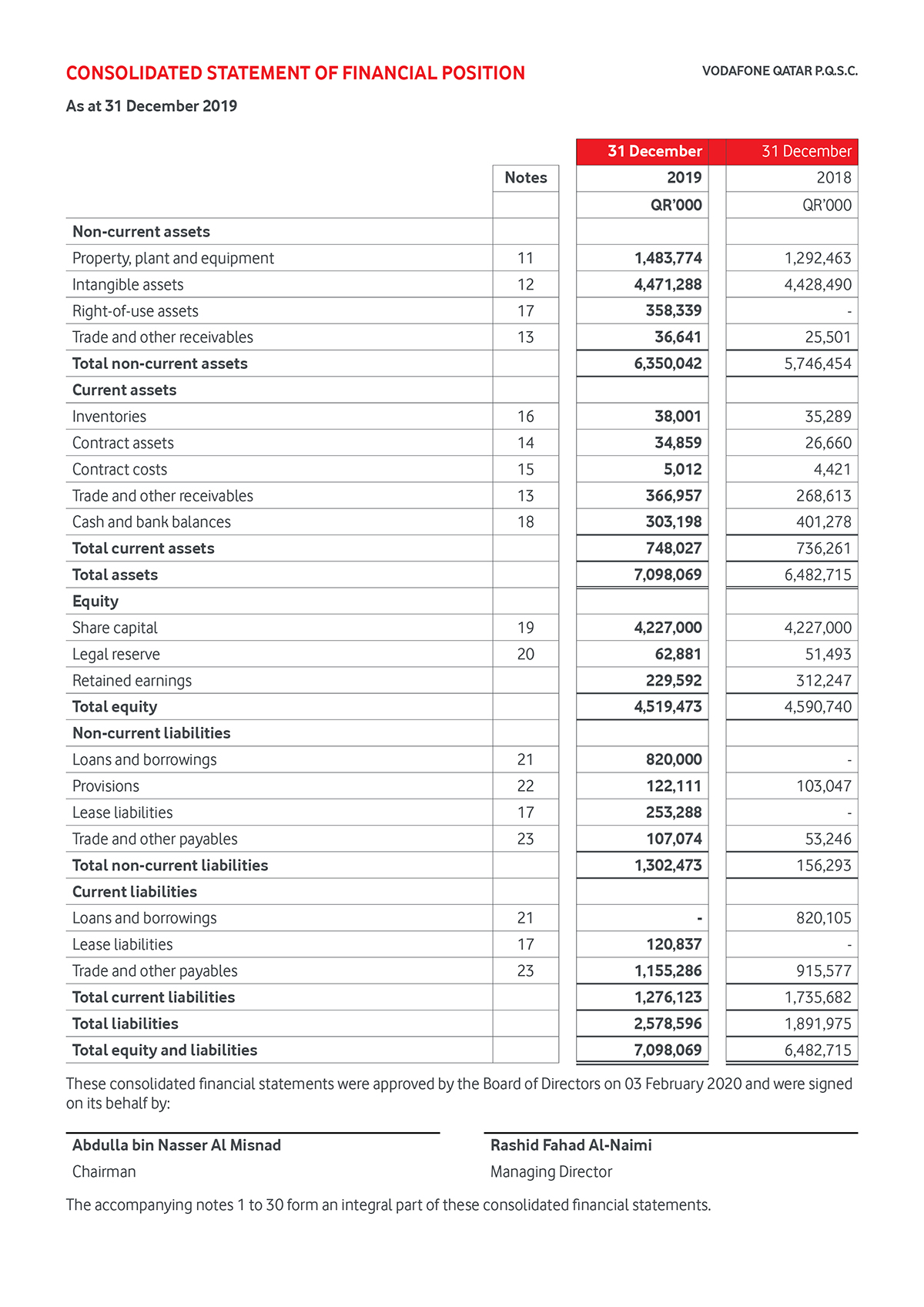

Statement of Financial Position

STATEMENT OF FINANCIAL POSITION

As at 31 December 2019

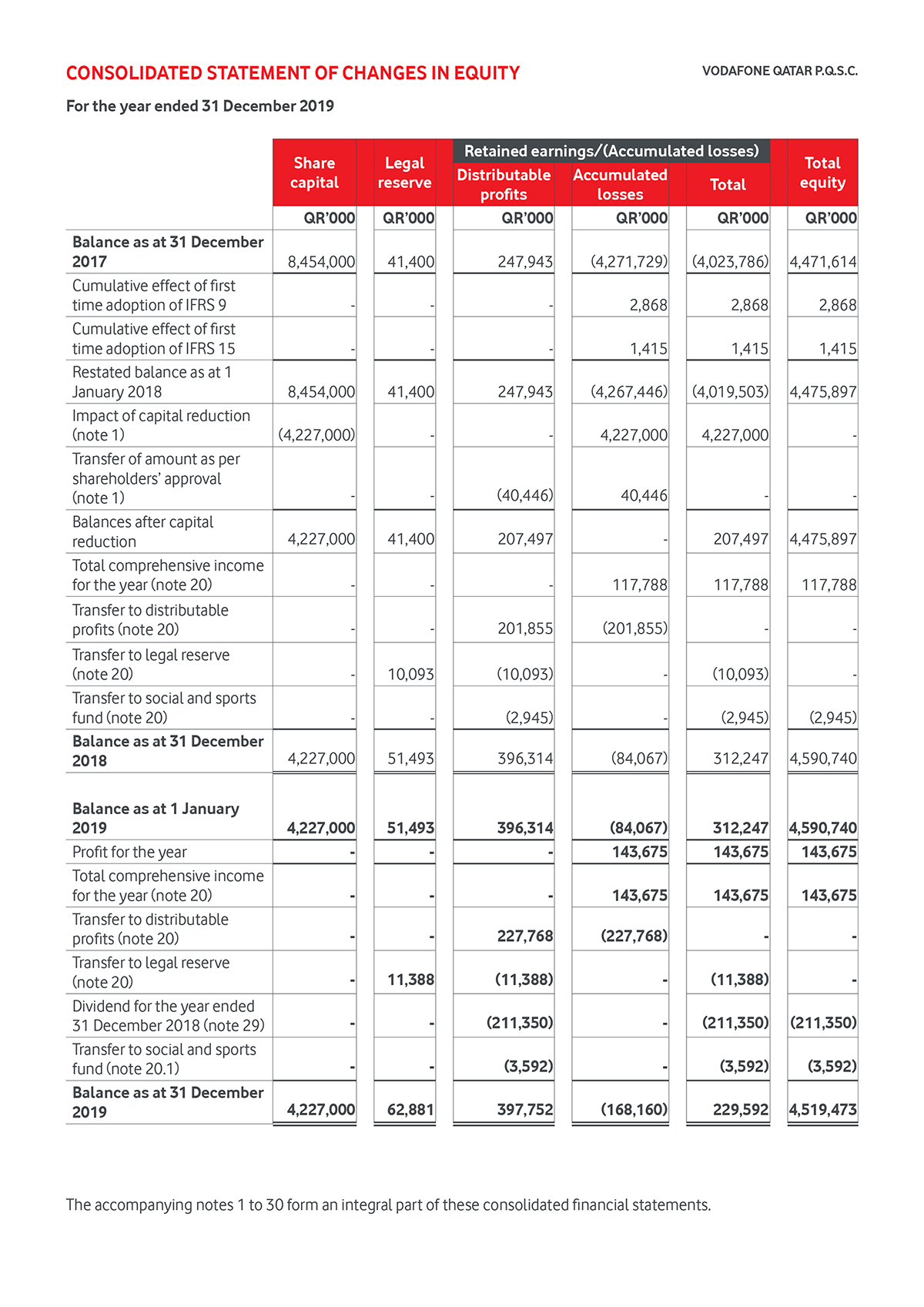

Statement of Changes in Equity

STATEMENT OF CHANGES IN EQUITY

For the year ended 31 December 2019

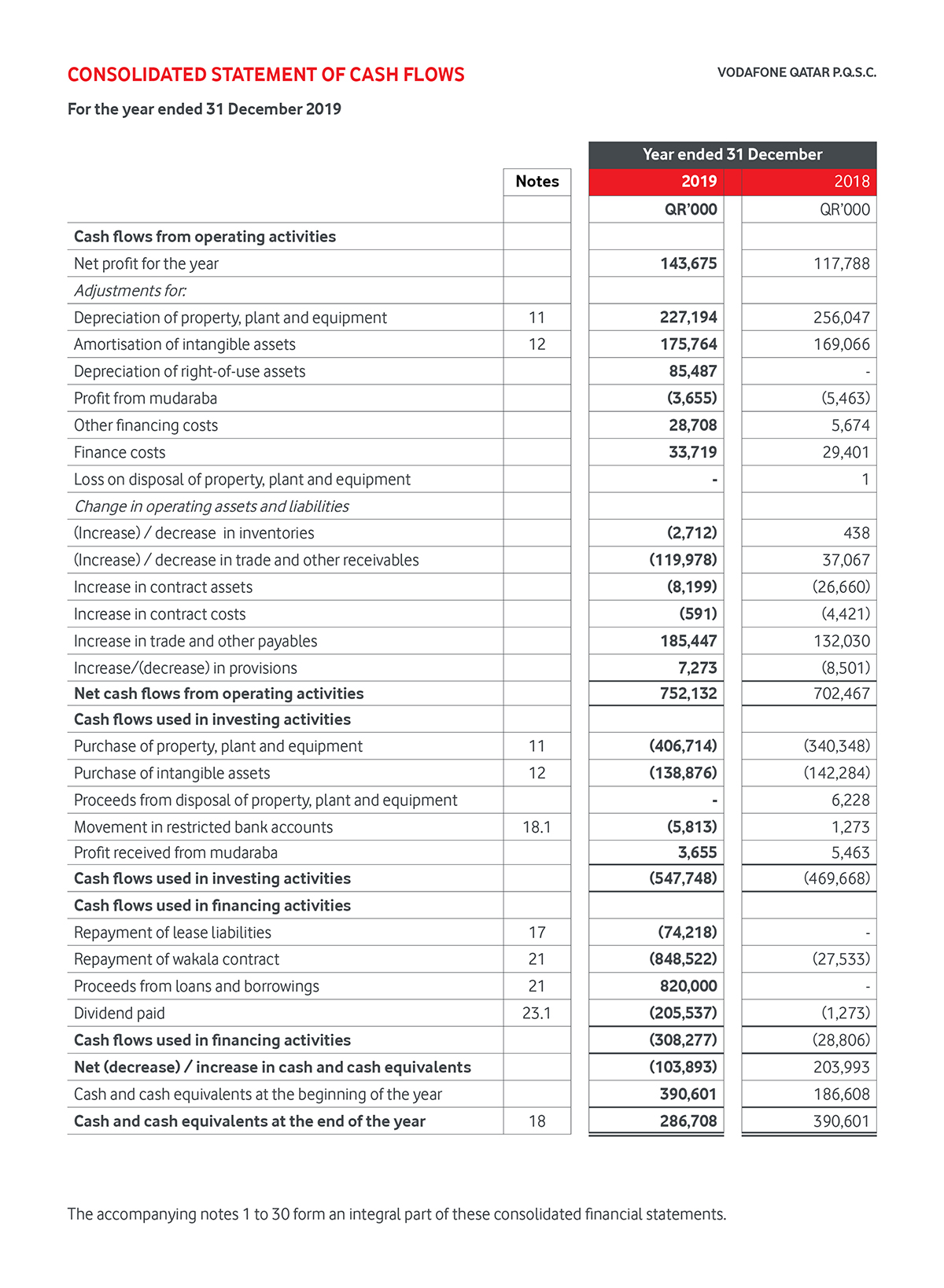

Statement of Cash Flows

STATEMENT OF CASH FLOWS

For the year ended 31 December 2019

NOTES TO THE FINANCIAL STATEMENTS

For the year ended 31 December 2019

1 INCORPORATION AND PRINCIPAL ACTIVITIES

Vodafone Qatar P.Q.S.C. (the “Company”) is registered as a Qatari Shareholding Company for a twenty- five year period (which may be extended by a resolution passed at a General Assembly) under Article 68 of the Qatar Commercial Companies Law Number 5 of 2002. The Company was registered with the Commercial Register of the Ministry of Economy and Commerce on 23 June 2008 under Commercial Registration No: 39656. The shares of the Company are listed on the Qatar Exchange.

Vodafone Group Plc was the ultimate parent of the Company until March 2018. However, pursuant to change in ownership of the immediate parent company i.e. Vodafone & Qatar Foundation LLC during the previous year, Qatar Foundation has now become the ultimate parent of the Company.

The Company is licensed by the Ministry of Transport and Communications (formerly Supreme Council of Information and Communication Technology (ictQATAR)) to provide both fixed and mobile telecommunications services in the State of Qatar. The conduct and activities of the Company are primarily regulated by the Communications Regulatory Authority (CRA) pursuant to Law No. 34 of 2006 (Telecommunications Law), the terms of its mobile and fixed licences and applicable regulations.

The Company is engaged in providing cellular mobile telecommunication services, fixed line and broadband services and selling related equipment and accessories. The Company’s head office is located in Doha, State of Qatar and its registered address is P.O. Box 27727, Qatar Science and Technology Park, Doha, State of Qatar.

On 25 March 2018, the Company was granted a 40 years’ extension to its Public Mobile Telecommunications Network and Services Licence (the “Licence”) as a result of which the Licence will expire on 28 June 2068.

In 2018, to extinguish accumulated losses associated with the amortisation costs of the Company’s Telecommunications Networks and Services Licence, the Company implemented a reduction in the share capital from QR 8,454 million to QR 4,227 million by means of reducing the nominal value of the shares of the Company from QR 10 per share to QR 5 per share in accordance with the relevant provisions of Articles 201 to 204 of the Commercial Companies Law No.11 of 2015, and the Articles of Association of the Company. The remaining balance of accumulated losses was extinguished by transferring an amount of QR 40.45 million from distributable profits to accumulated losses. The Company obtained its shareholders’ approval at the Company’s Extraordinary General Assembly held on 19 March 2018. The capital reduction was approved by Qatar Financial Markets Authority on 19 September 2018 and by Ministry of Economy and Commerce on 11 October 2018 together with the approval of the amended Articles of Association. The authenticated and approved Articles of Association were published in the Official Gazette on 18 November 2018. The capital reduction transaction took effect on 15 November 2018 and had no impact whatsoever on value or the number of the shares held by shareholders or on the total equity, cash position or financial liquidity of the Company as of that date.

In 2019, to comply with the instructions of Qatar Financial Markets Authority, the Company implemented a 5 for 1 share split i.e. 5 new shares with a par value of QR 1 each were issued in exchange of 1 old share with a par value of QR 5 each. The Company obtained its shareholders’ approval at the Company’s Extraordinary General Assembly held on 4 March 2019. The share split was approved by Ministry of Economy and Commerce together with the approval of the amended Articles of Association on 22 May 2019. The listing of the new shares on Qatar Exchange was effective from 4 July 2019.

During the year, the Company established a fully owned subsidiary, Infinity Solutions LLC (the “Subsidiary”). The Subsidiary will provide various operational and administrative services directly to its parent company Vodafone Qatar P.Q.S.C. in specific business areas. As of reporting date, the Subsidiary is yet to commence its commercial operations.

2 BASIS OF PREPARATION

Statement of compliance

These consolidated financial statements are prepared in accordance with International Financial Reporting Standards (IFRSs) as issued by the International Accounting Standards Board (IASB), applicable provisions of Qatar Commercial Company Law and the Company’s Articles of Association.

Accounting convention

These consolidated financial statements are prepared on a historical cost basis.

Functional and presentation currency

These consolidated financial statements are presented in Qatari Riyals, which is the Group’s functional and presentation currency. All the financial information presented in Qatari Riyals has been rounded off to the nearest thousand (QR’000) unless indicated otherwise.

Use of estimates and judgments

The preparation of consolidated financial statements in conformity with IFRS requires management to make estimates and assumptions that affect the reported amounts of assets and liabilities and disclosure of contingent assets and liabilities at the date of the consolidated financial statements and reported amounts of revenue and expenses during the reporting year. For a discussion on the Group’s critical accounting estimates see “Critical accounting judgements and key sources of estimation uncertainty” under note 27. Actual results could differ from those estimates. The estimates and underlying assumptions are reviewed on an ongoing basis. Revisions to accounting estimates are recognised in the period in which the estimate is revised if the revision affects only that period or in the period of the revision and future periods if the revision affects both current and future periods.

3 SIGNIFICANT ACCOUNTING POLICIES

The following accounting policies are consistently applied to all periods presented in these consolidated financial statements, and have been applied consistently by the Group entities:

Basis of consolidation

These consolidated financial statements include the financial statements of the Company and the Subsidiary together constituting "the Group".

Subsidiaries

Subsidiaries are all entities over which the Company has control. The Company controls an entity when the Company is exposed to, or has rights to, variable returns from its involvement with the entity and has the ability to affect those returns through its power to direct the activities of the entity. Subsidiaries are fully consolidated from the date on which control is transferred to the Company. They are deconsolidated from the date that control ceases.

Intercompany transactions, balances and unrealised gains on transactions between Group companies are eliminated upon consolidation. Unrealised losses are also eliminated unless the transaction provides evidence of an impairment of the transferred asset. Accounting policies of the Subsidiary are consistent with the policies adopted by the Group.

If the Subsidiary is not fully owned, non-controlling interests in the results and equity of the subsidiary are shown separately in the consolidated statement of income, statement of comprehensive income, statement of changes in equity and statement of financial position respectively.

Changes in ownership interest

When the Group ceases to consolidate or equity account for an investment because of a loss of control, joint control or significant influence, any retained interest in the entity is remeasured to its fair value with the change in carrying amount recognized in statement of income. This fair value becomes the initial carrying amount for the purposes of subsequently accounting for the retained interest as an associate, joint venture or financial asset.

Revenue recognition

The Group recognises revenue from providing the following telecommunication services: access charges, airtime usage, messaging, interconnect fees, data broadband services and information provision, connection fees and equipment sales.

Revenue is measured based on the consideration to which the Group expects to be entitled in a contract with a customer and excludes amounts collected on behalf of third parties. The Group recognises revenue when it transfers control of a product or service to a customer.

The Group sells equipment/accessories both to the wholesale market and directly to customers through its own retail outlets. Sales-related warranties associated with goods cannot be purchased separately and they serve as an assurance that the products sold comply with agreed-upon specifications. Accordingly, the Group accounts for warranties in accordance with IAS 37 Provisions, Contingent Liabilities and Contingent Assets consistent with its previous accounting treatment.

For sale of equipment to the wholesale market, revenue is recognised when control of the goods has transferred, being when the goods have been shipped to the wholesaler’s specific location (delivery). Following delivery, the wholesaler has full discretion over the manner of distribution and price to sell the goods, has the primary responsibility when selling the goods and bears the risks of obsolescence and loss in relation to the goods. A receivable is recognised by the Group when the goods are delivered to the wholesaler as this represents the point in time at which the right to consideration becomes unconditional, as only the passage of time is required before payment is due.

For sales of equipment to retail customers, revenue is recognised when control of the goods has transferred, being at the point the customer purchases the goods at the retail outlet. Payment of the transaction price is due immediately at the point the customer purchases the equipment.

Under the Group’s standard contract terms, customers have a right of return within 7 days. The Group uses its accumulated historical experience to estimate the number of returns on a portfolio level using the expected value method. It is considered highly probable that a significant reversal in the cumulative revenue recognised will not occur given the consistent level of immaterial returns over previous years.

Revenue from access charges, airtime usage and messaging by contract customers is recognised as services are performed, with unbilled revenue resulting from services already provided accrued at the end of each period and unearned revenue from services to be provided in future periods deferred. Revenue from the sale of prepaid credit is deferred until such time as the customer uses the airtime, or the credit expires. Revenue from data services and information provision is recognised when the Group has performed the related service and, depending on the nature of the service, is recognised either at the gross amount billed to the customer or the amount receivable by the Group as commission for facilitating the service. Revenue from interconnect fees is recognised at the time the services are performed.

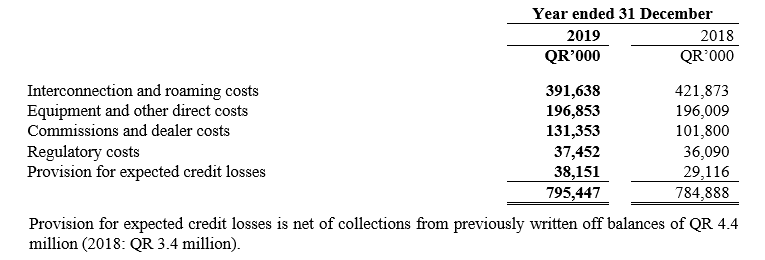

Interconnection and other direct expenses

Interconnection and other expenses include interconnection charges, commissions and dealer charges, regulatory costs, cost of equipment sold, bad debt costs and other direct and access costs.

Interconnection and roaming costs

Costs of network interconnection and roaming with other domestic and international telecommunications operators are recognised in the consolidated statement of income on an accrual basis based on the actual recorded traffic usage.

Commissions and dealer costs

Intermediaries are given cash incentives by the Group to connect new customers, upgrade existing customers, and distribute recharge cards. These cash incentives are recognised in consolidated statement of income on an accrual basis. Commission related to the acquisition of new customers is capitalised and amortised over the contract period.

Regulatory costs

The annual license fee, spectrum charges and numbering charges are accrued as other operational expenses based on the terms of the License Fee Agreement and relevant applicable regulatory framework issued by the CRA.

Leases – [Upon adoption of IFRS 16 ¬– applicable from 1 January 2019]

The Group leases various offices, cell sites, warehouses, ducts, retail stores and equipment. Rental contracts are typically made for fixed periods of 5-10 years but may have extension options. Lease terms are negotiated on an individual basis and contain a wide range of different terms and conditions. The lease agreements do not impose any covenants and leased assets are not used as security for borrowing purposes.

The Group assesses whether contract is or contains a lease, at inception of the contract. The Group recognises a right-of-use asset and a corresponding lease liability with respect to all lease arrangements in which it is the lessee, except for certain short-term leases (defined as leases with a lease term of 12 months or less) and leases of low value assets. For these leases, the Group recognises the lease payments as an operating expense on a straight-line basis over the term of the lease unless another systematic basis is more representative of the time pattern in which economic benefits from the leased assets are consumed.

The lease liability is initially measured at the present value of the lease payments that are not paid at the commencement date, discounted by using the rate implicit in the lease. If this rate cannot be readily determined, the Group uses its incremental borrowing rate.

Lease payments included in the measurement of the lease liability comprise:

- fixed lease payments (including in-substance fixed payments), less any lease incentives;

- variable lease payments that depend on an index or rate, initially measured using the index or rate at the commencement date;

- the amount expected to be payable by the lessee under residual value guarantees;

- the exercise price of purchase options, if the lessee is reasonably certain to exercise the options; and

- payments of penalties for terminating the lease, if the lease term reflects the exercise of an option to terminate the lease

The lease liability is presented as a separate line item in the consolidated statement of financial position.

The lease liability is subsequently measured by increasing the carrying amount to reflect interest on the lease liability (using effective interest method) and by reducing the carrying amount to reflect the lease payments made.

The Group remeasures the lease liability (and makes a corresponding adjustment to the related right-of-use asset) whenever:

- The lease term has changed or there is a change in the assessment of exercise of a purchase option, in which case the lease liability is remeasured by discounting the revised lease payments using a revised discount rate.

- The lease payments change due to changes in an index or rate or a change in expected payment under a guaranteed residual value, in which cases the lease liability is remeasured by discounting the revised lease payments using the initial discount rate (unless the lease payments change is due to a change in a floating interest rate, in which case a revise discount rate is used).

- A lease contract is modified and the lease modification is not accounted for as a separate lease, in which case the lease liability is remeasured by discounting the revised lease payments using a revised discount rate.

The Group did not make any such adjustments during the periods presented.

The right-of-use assets are depreciated over the shorter period of lease term and useful life of the underlying asset. If a lease transfers ownership of the underlying asset or the cost of the right-of-use of asset reflects that the Group expects to exercise a purchase option, the related right-of-use asset is depreciated over the useful life of the underlying asset. The depreciation starts at the commencement date of the lease.

The right-of-use of assets are presented as a separate line in the consolidated statement of financial position.

The Group applies IAS 36 to determine whether a right-of-use asset is impaired and accounts for an identified impairment loss as described in the ‘Property, plant and equipment’s policy.

Variable rents that do not depend on an index or rate are not included in the measurement of the lease liability and the right-of-use asset. The related payments are recognised as an expense in the period in which the event or condition that triggers those payments occurs and are included in the consolidated statement of income.

As a practical expedient, IFRS16 permits a lessee not to separate non-lease components, and instead account for any lease and associated non-lease components as a single arrangement. The Group has used this practical expedient.

Operating leases- [Lease under IAS 17, applicable before 1 January 2019]

Operating lease payments are recognised as an expense on a straight-line basis over the lease term, except where another systematic basis is more representative of the time pattern in which economic benefits from the leased asset are consumed. Contingent rentals arising under operating leases are recognised as an expense in the period in which they are incurred. In the event that lease incentives are received to enter into operating leases, such incentives are recognised as a liability. The aggregate benefit of incentives is recognised as a reduction of rental expense on a straight-line basis, except where another systematic basis is more representative of the time pattern in which economic benefits from the leased asset are consumed.

Foreign currencies

Transactions in foreign currencies are initially recorded by the Group at the currency rate prevailing at the date of the transaction. Any differences on settlement of the transaction are immediately recognised in the consolidated statement of income. Monetary assets and liabilities denominated in foreign currencies are retranslated at the functional currency spot rate of exchange ruling at the end of the reporting period. Foreign exchange gains and losses resulting from the settlement of such transactions and from the translation at reporting period-end exchange rates of monetary assets and liabilities denominated in foreign currencies are recognised in the consolidated statement of income.

Borrowing costs

The borrowing costs incurred on funding construction of qualifying assets are capitalised as being part of cost of construction. All other borrowing costs are recognised on an accrual basis using the effective yield method in the consolidated statement of income during the year in which they arise.

Income tax

As per Income Tax Law No. 24 of 2018, corporate income tax is levied on companies that are not wholly owned by Qataris or any GCC nationals, based on the net profit of the Group. As per the provisions of the law, the Group is not subject to corporate income tax as it is listed on the Qatar Stock Exchange.

Property, plant and equipment

As per Income Tax Law No. 24 of 2018, corporate income tax is levied on companies that are not wholly owned by Qataris or any GCC nationals, based on the net profit of the Group. As per the provisions of the law, the Group is not subject to corporate income tax as it is listed on the Qatar Stock Exchange.

Recognition and measurement

Furniture and fixtures and network, plant and equipment are stated at cost less accumulated depreciation and accumulated impairment losses (if any). Assets in the course of construction are carried at cost, less any recognised impairment losses.

The cost of property, plant and equipment includes directly attributable incremental costs incurred in their acquisition and installation. The costs of self-constructed assets include the cost of materials and direct labour, any other costs directly attributable for bringing the assets to a working condition for their intended use, capitalised borrowing costs and estimated discounted costs for dismantling and restoration of the sites, where the Group has an obligation to restore the sites.

Depreciation

Depreciation of these assets commences when the assets are ready for use as intended by the management. Depreciation is charged so as to write off the cost of assets, other than assets under construction, over their estimated useful lives using the straight line method as follows:

Leasehold improvements Lease term

Network infrastructure 3 - 25 years

Other equipment 1 - 5 years

Furniture and fixtures 5 years

Others 3 - 5 years

Derecognition

An item of property, plant and equipment is derecognised upon disposal or when no future economic benefits are expected from its use or disposal. The gain or loss arising on the disposal or retirement of an item of property, plant and equipment is determined as the difference between the sales proceeds and the carrying amount of the asset and is recognised in the consolidated statement of income.

Intangible assets

Identifiable intangible assets are recognised when the Group controls the asset, it is probable that future economic benefits will flow to the Group and the cost of the asset can be reliably measured. Intangible assets include license fees, software and indefeasible rights of use (“IRU”). Intangible assets with finite useful lives are subsequently carried at cost less accumulated amortization and impairment loss, if any.

License

Licence is stated at cost less accumulated amortisation. The amortisation period is determined primarily by reference to the unexpired licence period, the conditions for the licence renewal and whether licences are dependent on specific technologies. Amortisation is charged to the consolidated statement of income on a straight-line basis over the estimated useful lives from the commencement of service of the network. The estimated useful lives of the mobile and fixed line licenses are 60 years and 25 years respectively.

Indefeasible rights of use (“IRU”)

IRUs correspond to the right to use a portion of the capacity of a terrestrial or submarine transmission cable granted for a fixed period. IRUs are recognised at cost as an intangible asset when the Group has the indefeasible right to use a specific asset, generally specific optical fibres or dedicated wavelengths on specific cables, and the duration of the right is for the major part of the underlying asset’s economic life. IRU’s are considered as intangible assets with finite lives based on the contractual period/term.

Other finite lived intangible assets (including software)

Intangible assets with finite lives are stated at acquisition or development cost, less accumulated amortisation. The amortisation period and method is reviewed at least annually. Changes in the expected useful life or the expected pattern of consumption of future economic benefits embodied in the asset is accounted for by changing the amortisation period or method, as appropriate, and are treated as changes in accounting estimates. The amortisation expense on intangible assets with finite lives is recognised in consolidated statement of income on a straight line basis (3 to 5 years).

Capital work in progress

Capital work-in-progress is transferred to the related property, plant and equipment or intangible assets when the construction or installation and related activities necessary to prepare the property, plant and equipment or intangible assets for their intended use have been completed, and related assets are ready for operational use.

Impairment of assets

Property, plant and equipment and finite lived intangible assets

At the end of each reporting period, the Group reviews the carrying amounts of its property, plant and equipment and finite lived intangible assets to determine whether there is any indication that those assets have suffered an impairment loss. If any such indication exists, the recoverable amount of the asset is estimated in order to determine the extent, if any, of the impairment loss. Recoverable amount is the higher of value in use and fair value less cost of disposal. Where it is not possible to estimate the recoverable amount of an individual asset, the Group estimates the recoverable amount of the cash-generating unit to which the asset belongs.

If the recoverable amount of an asset or cash-generating unit is estimated to be less than its carrying amount, the carrying amount of the asset or cash-generating unit is reduced to its recoverable amount. An impairment loss is recognised immediately in the consolidated statement of income.

Where an impairment loss subsequently reverses, the carrying amount of the asset or cash-generating unit is increased to the revised estimate of its recoverable amount, not to exceed the carrying amount that would have been determined had no impairment loss been recognised for the asset or cash-generating unit in prior periods. A reversal of an impairment loss is recognised immediately in the consolidated statement of income.

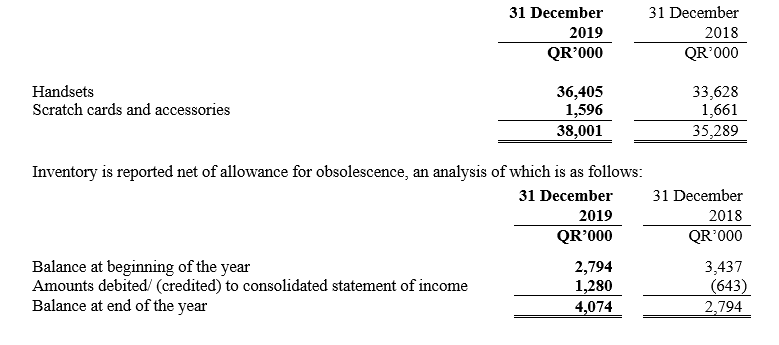

Inventories

Inventory is stated at the lower of cost and net realisable value. Cost is determined on the basis of weighted average cost and comprises direct materials and, where applicable, direct labour cost and those overheads that have been incurred in bringing the inventories to their present location and condition.

Employees’ end of service benefits

The Group provides end of service benefits to its employees. The entitlement to these benefits is based upon the employees' final salary and length of service, subject to the completion of a minimum service period, calculated under the provisions of Qatar Labour Law and is payable upon resignation or termination of the employee. The expected costs of these benefits are accrued over the period of employment.

Provisions

Provisions are recognised when the Group has a present obligation (legal or constructive) as a result of a past event, it is probable that the Group will be required to settle the obligation and a reliable estimate can be made of the amount of the obligation. The amount recognised as a provision is the best estimate of the consideration settle the present obligation at the reporting date, taking into account the risks and uncertainties surrounding the obligation. Where required to a provision is measured using the cash flows estimated to settle the present obligation, its carrying amount is the present value of those cash flows.

Financial Instruments

Non-derivative financial instruments

Financial assets and financial liabilities are recognised on the Group’s consolidated statement of financial position when the Group becomes a party to the contractual provisions of the instrument.

Financial assets

All regular way purchases or sales of financial assets are recognised and derecognised on a trade date basis. Regular way purchases or sales are purchases or sales of financial assets that require delivery of assets within the time frame established by regulation or convention in the marketplace. All recognised financial assets are measured subsequently in their entirety at either amortised cost or fair value, depending on the classification of the financial assets.

Classification of financial assets

(i) Debt instruments designated at amortised cost

Debt instruments that meet the following conditions are measured subsequently at amortised cost:

- The financial asset is held within a business model whose objective is to hold financial assets in order to collect contractual cash flows; and

- The contractual terms of the financial asset give rise on specified dates to cash flows that are solely payments of principal and interest on the principal amount outstanding.

Classification of financial assets

(ii) Debt instrument designated at other comprehensive income

Debt instruments that meet the following conditions are measured subsequently at fair value through other comprehensive income (FVTOCI):

- The financial asset is held within a business model whose objective is achieved by both collecting contractual cash flows and selling the financial assets; and

- The contractual terms of the financial asset give rise on specified dates to cash flows that are solely payments of principal and interest on the principal amount outstanding.

By default, all other financial assets are measured subsequently at fair value through profit or loss (FVTPL).

Despite the foregoing, the Group may make the following irrevocable election/designation at initial recognition of a financial asset:

- The Group may irrevocably elect to present subsequent changes in fair value of an equity investment in other comprehensive income if certain criteria are met; and

- The Group may irrevocably designate a debt investment that meets the amortised cost or FVTOCI criteria as measured at FVTPL if doing so eliminates or significantly reduces an accounting mismatch.

For financial instruments other than purchased or originated credit-impaired financial assets (i.e. assets that are credit-impaired on initial recognition), the effective interest rate is the rate that exactly discounts estimated future cash receipts (including all fees and points paid or received that form an integral part of the effective interest rate, transaction costs and other premiums or discounts) excluding expected credit losses, through the expected life of the debt instrument, or, where appropriate, a shorter period, to the gross carrying amount of the debt instrument on initial recognition.

For purchased or originated credit-impaired financial assets, a credit-adjusted effective interest rate is calculated by discounting the estimated future cash flows, including expected credit losses, to the amortised cost of the debt instrument on initial recognition.

Amortised cost and effective interest rate method

The amortised cost of a financial asset is the amount at which the financial asset is measured at initial recognition minus the principal repayments, plus the cumulative amortisation using the effective interest method of any difference between that initial amount and the maturity amount, adjusted for any loss allowance. The gross carrying amount of a financial asset is the amortised cost of a financial asset before adjusting for any loss allowance.

The effective interest method is a method of calculating the amortised cost of a debt instrument and of allocating interest income over the relevant period.

Interest income is recognised using the effective interest method for debt instruments measured subsequently at amortised cost and at FVTOCI. For financial instruments other than purchased or originated credit-impaired financial assets, interest income is calculated by applying the effective interest rate to the gross carrying amount of a financial asset, except for financial assets that have subsequently become credit-impaired (see below). For financial assets that have subsequently become credit-impaired, interest income is recognised by applying the effective interest rate to the amortised cost of the financial asset. If, in subsequent reporting periods, the credit risk on the credit-impaired financial instrument improves so that the financial asset is no longer credit-impaired, interest income is recognised by applying the effective interest rate to the gross carrying amount of the financial asset.

For purchased or originated credit-impaired financial assets, the Group recognises interest income by applying the credit-adjusted effective interest rate to the amortised cost of the financial asset from initial recognition. The calculation does not revert to the gross basis even if the credit risk of the financial asset subsequently improves so that the financial asset is no longer credit-impaired.

Financial assets recognised by the Group include:

Trade receivables and contract assets

Trade receivables do not carry any interest and are stated at their nominal value as reduced by appropriate allowances for estimated irrecoverable amounts. Estimated irrecoverable amounts are based on the ageing of the receivable balances, historical experience or when the counterparty has been placed under liquidation or entered into bankruptcy proceedings. Individual trade receivables are provided as per Expected Credit Loss (“ECL”) policy and written off when management deems them not to be collectible based on above mentioned criteria.

Cash and cash equivalents

Cash and cash equivalents comprise cash on hand, bank balances and Mudaraba deposits that are readily convertible to a known amount of cash and are subject to an insignificant risk of change in value.

Mudaraba is a short term bank deposit made by the Group under the terms of Sharia principles. The profit from such deposits is accrued in the consolidated statement of income on periodic basis.

Derecognition of financial assets

A financial asset (or, where applicable a part of a financial asset or part of a group of similar financial assets) is derecognised where:

- The contractual rights to receive cash flows from the asset have expired;

- The Group retains the right to receive cash flows from the asset, but has assumed an obligation to pay them in full without material delay to a third party under a ‘pass-through’ arrangement; or

- The Group has transferred its rights to receive cash flows from the asset and either (a) has transferred substantially all the risks and rewards of the asset, or (b) has neither transferred nor retained substantially all the risks and rewards of the asset, but has transferred control of the asset.

Impairment of financial assets

The Group recognises a loss allowance for expected credit losses on trade receivables, contract assets and lease receivables. The amount of expected credit losses is updated at each reporting date to reflect changes in credit risk since initial recognition of the respective financial instrument.

The Group always recognises lifetime expected credit losses for trade receivables, contract assets and other receivables. The expected credit losses on these financial assets are estimated using a provision matrix based on the Group’s historical credit loss experience, adjusted for factors that are specific to the debtors, general economic conditions and an assessment of both the current as well as the forecast direction of conditions at the reporting date, including time value of money where appropriate.

Financial assets, other than those at fair value through profit and loss, are assessed for indicators of impairment at reporting date. Financial assets are impaired where there is objective evidence that, as a result of one or more events that occurred after the initial recognition of the financial asset, the estimated future cash flows of the investment have been impacted. For trade receivables, objective evidence of impairment could include: (i) significant financial difficulty of the issuer or counterparty; (ii) default or delinquency in interest or principal payments; or (iii) it is becoming probable that the borrower will enter bankruptcy or financial re-organisation.

For certain categories of financial assets, such as trade receivables, assets that are assessed not to be impaired individually are subsequently assessed for impairment on a collective basis. Objective evidence of impairment for a portfolio of receivables could include the Group’s past experience of collecting payments, an increase in the number of delayed payments in the portfolio past the average credit period, as well as observable changes in national or local economic conditions that correlate with default on receivables. For financial assets carried at amortised cost, the amount of the impairment is the difference between the asset’s carrying amount and the present value of estimated future cash flows, discounted at the financial asset’s original effective interest rate.

Equity instruments

An equity instrument is any contract that evidences a residual interest in the assets of the Group after deducting all of its liabilities and includes no obligation to deliver cash or other financial assets.

Financial liabilities

All financial liabilities are measured subsequently at amortised cost using the effective interest method or at FVTPL. However, financial liabilities that arise when a transfer of a financial asset does not qualify for derecognition or when the continuing involvement approach applies, and financial guarantee contracts issued by the Group, are measured in accordance with the specific accounting policies set out below.

Financial liabilities at FVTPL

Financial liabilities are classified as at FVTPL when the financial liability is (i) contingent consideration of an acquirer in a business combination, (ii) held for trading or (iii) it is designated as at FVTPL.

A financial liability is classified as held for trading if:

- It has been acquired principally for the purpose of repurchasing it in the near term; or

- On initial recognition it is part of a portfolio of identified financial instruments that the Group manages together and has a recent actual pattern of short-term profit-taking; or

- It is a derivative, except for a derivative that is a financial guarantee contract or a designated and effective hedging instrument.

A financial liability other than a financial liability held for trading or contingent consideration of an acquirer in a business combination may be designated as at FVTPL upon initial recognition if:

- Such designation eliminates or significantly reduces a measurement or recognition inconsistency that would otherwise arise; or

- The financial liability forms part of a Group’ financial assets or financial liabilities or both, which is managed and its performance is evaluated on a fair value basis, in accordance with the Group’s documented risk management or investment strategy, and information about the same is provided internally on that basis; or

- It forms part of a contract containing one or more embedded derivatives, and IFRS 9 permits the entire combined contract to be designated as at FVTPL.

Financial liabilities at FVTPL are stated at fair value, with any gains or losses arising on changes in fair value recognised in profit or loss to the extent that they are not part of a designated hedging relationship. The net gain or loss recognised in profit or loss incorporates any interest paid on the financial liability.

However, for financial liabilities that are designated as at FVTPL, the amount of change in the fair value of the financial liability that is attributable to changes in the credit risk of that liability is recognised in other comprehensive income, unless the recognition of the effects of changes in the liability’s credit risk in other comprehensive income would create or enlarge an accounting mismatch in profit or loss. The remaining amount of change in the fair value of liability is recognised in profit or loss.

Changes in fair value attributable to a financial liability’s credit risk that are recognised in other comprehensive income are not subsequently reclassified to profit or loss; instead, they are transferred to retained earnings upon derecognition of the financial liability.

Gains or losses on financial guarantee contracts issued by the Group that are designated by the Group as at FVTPL are recognised in profit or loss.

Financial liabilities measured subsequently at amortised cost

Financial liabilities that are not (i) contingent consideration of an acquirer in a business combination, (ii) held-for-trading, or (iii) designated as at FVTPL, are measured subsequently at amortised cost using the effective interest method.

The effective interest method is a method of calculating the amortised cost of a financial liability and of allocating interest expense over the relevant period. The effective interest rate is the rate that exactly discounts estimated future cash payments (including all fees and points paid or received that form an integral part of the effective interest rate, transaction costs and other premiums or discounts) through the expected life of the financial liability, or (where appropriate) a shorter period, to the amortised cost of a financial liability.

Financial guarantee contract liabilities

A financial guarantee contract is a contract that requires the issuer to make specified payments to reimburse the holder for a loss it incurs because a specified debtor fails to make payments when due in accordance with the terms of a debt instrument.

Financial guarantee contract liabilities are measured initially at their fair values and, if not designated as at FVTPL and do not arise from a transfer of an asset, are measured subsequently at the higher of:

- The amount of the loss allowance determined in accordance with IFRS 9 (see financial assets above); and

- The amount recognised initially less, where appropriate, cumulative amortisation recognised in accordance with the revenue recognition policies set out above.

Foreign exchange gains and losses

For financial liabilities that are denominated in a foreign currency and are measured at amortised cost at the end of each reporting period, the foreign exchange gains and losses are determined based on the amortised cost of the instruments. Foreign exchange gains and losses on financial liabilities that are not part of a designated hedging relationship are recognised in consolidated statement of income. For those which are designated as a hedging instrument for a hedge of foreign currency risk foreign exchange gains and losses are recognised in other comprehensive income and accumulated in a separate component of equity.

The fair value of financial liabilities denominated in a foreign currency is determined in that foreign currency and translated at the spot rate at the end of the reporting period. For financial liabilities that are measured as at FVTPL, the foreign exchange component forms part of the fair value gains or losses and is recognised in profit or loss for financial liabilities that are not part of a designated hedging relationship.

Financial liabilities recognised by the Group include:

Trade payables

Trade payables are not interest bearing and are stated at their nominal value.

Wakala contract liabilities

The Group entered into a wakala contract in the capacity of a wakil. Wakala is an agreement between two parties whereby one party (the “Muwakkil”) provides funds (“Investment Amount”) to an agent (the “Wakil”), to invest on their behalf in accordance with the principles of Sharia. The Investment Amount is available for unrestricted use for capital expenditure, operational expenses and for settlement of liabilities.

If profits are made, the Wakil will pay an agreed-upon share of these profits to the Muwakkil. The Investment Amount is repaid back at the end of the investment period along with any accumulated profits. Hence Wakala contract are stated at amortised cost in the consolidated statement of financial position. The attributable profits are recognised as wakala contract costs in the consolidated statement of income on a time apportionment basis, taking account of the anticipated profit rate and the balance outstanding.

Term Finance Loan

Term Finance Loan is recognised initially at fair value of the consideration received, less directly attributable transaction costs. Subsequent to initial recognition, term finance loan is measured at amortised cost using the effective interest method. Instalments due within one year at amortised cost are shown as a current liability. Gains or losses are recognised in the consolidated statement of income when the liabilities are derecognised as well as through the amortisation process. Interest costs are recognised as an expense when incurred except those eligible for capitalisation.

Equity instruments

Ordinary shares issued by the Group are classified as equity.

Derecognition of financial liabilities

A financial liability is derecognised when the obligation under the liability is discharged or cancelled or expires. Where an existing financial liability is replaced by another from the same lender on substantially different terms, or the terms of an existing liability are substantially modified, such an exchange or modification is treated as a derecognition of the original liability and the recognition of a new liability, and the difference in the respective carrying amounts is recognised in the consolidated statement of income.

Derivative financial instruments

The Group uses derivative financial instruments to reduce its financial risks due to changes in foreign exchange rates. Derivative financial instruments are initially measured at fair value on the contract date and are subsequently remeasured to fair value at each reporting date.

Dividend on ordinary share capital

Dividend distributions to the Group’s shareholders are recognised as a liability in the consolidated financial statements in the period in which the dividend is approved by the shareholders. Dividend for the year that is approved after the consolidated statement of financial position date is dealt with as a non-adjusting event after the balance sheet date.

4 SEGMENT REPORTING

Operating segments are components that engage in business activities that may earn revenues or incur expenses, whose operating results are regularly reviewed by the chief operating decision maker (CODM), and for which discrete financial information is available. The CODM is the person or group of persons who allocates resources and assesses the performance of the components. The functions of the CODM are performed by the Board of Directors of the Group.

(a) Description of products and services from which each reportable segment derives its revenue and factors that management used to identify the reportable segments

The Group only operates in Qatar and is therefore viewed to operate in one geographical area. Management also views that its mobile business is the main operating segment of the Group. Fixed line services are reported in the same operating segment as they are currently insignificant to the overall business. The Group does not have any customer segment for which the revenues exceeds 10% of the total revenue of the Group.

(b) Measurement of operating segment profit or loss, assets and liabilities

The CODM reviews financial information prepared based on IFRS adjusted to meet the requirements of internal reporting. Such financial information does not significantly differ from that presented in these consolidated financial statements.

5 REVENUE

6 INTERCONNECTION AND OTHER DIRECT EXPENSES

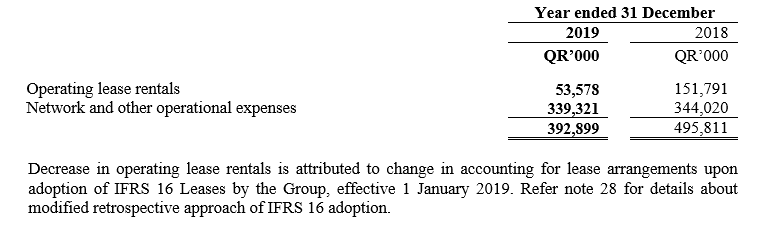

7 NETWORK, RENTALS AND OTHER OPERATIONAL EXPENSES

8 OTHER FINANCING COSTS

Other financing costs include unwinding of discounted portion of asset retirement obligations (note 22.1). This also includes interest expense on lease liabilities amounted to QR 15 million (note 17) and certain other ancillary costs.

9 INDUSTRY FEE

In accordance with its operating licenses for Public Telecommunications Networks and Services granted in Qatar by ictQatar, now referred to as the Communications Regulatory Authority (CRA), the Company is liable to pay to the CRA an annual industry fee which is calculated at 12.5% of adjusted net profit on regulated activities.

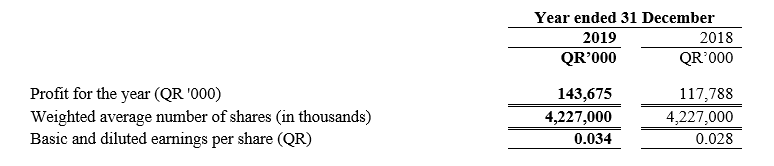

10 BASIC AND DILUTED EARNINGS PER SHARE

As a result of the share split, the weighted average number of shares and the earnings per share has been retrospectively adjusted and the comparatives have been restated. Refer note 19.1 for further details. There is no dilutive element and hence the basic and diluted shares are the same.

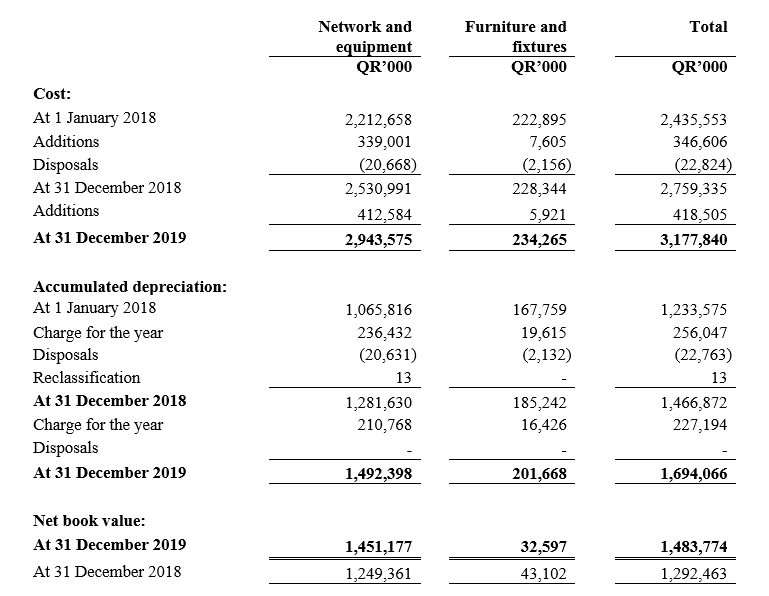

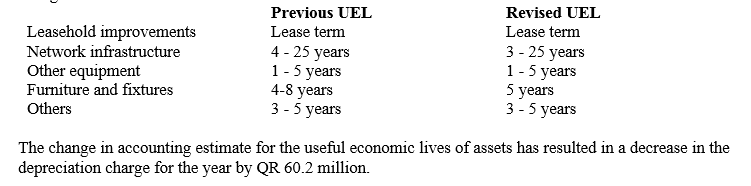

11 PROPERTY, PLANT AND EQUIPMENT

The net book value of property, plant and equipment includes assets under construction amounting to QR 139 million (2018: QR 164 million), which are not depreciated.

The net book value of property, plant and equipment includes the net book of the asset related to asset retirement obligation amounting to QR 49.84 million (2018: 48.13 million)

During the year, the Group conducted a review of expected useful economic lives (UEL) of its assets. The change in accounting estimate for the useful economic lives of assets has resulted in a decrease in the depreciation charge for the year by QR 60.2 million (refer note 27).

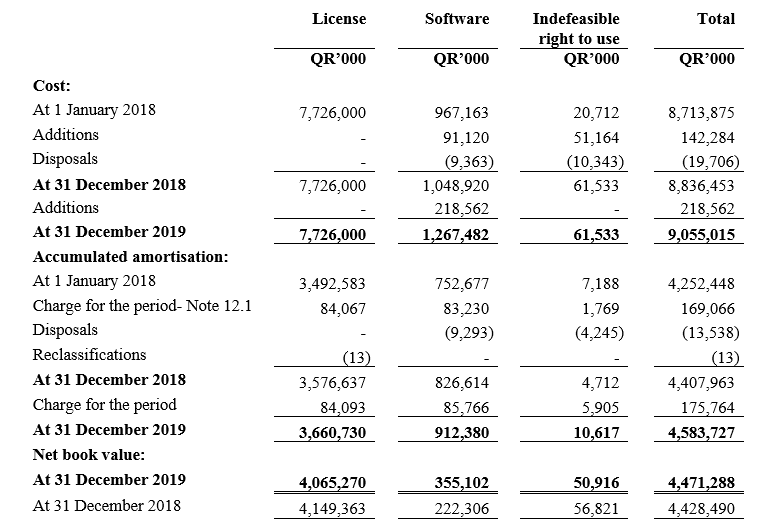

12 INTANGIBLE ASSETS

12.1 In year 2018, the Company was granted a 40 year’s extension to its Mobile Telecommunication Network and Services License (the License”) at no additional cost. As a result of the extension, the License will expire on 28 June 2068 as it was originally granted to the Company on 29 June 2008 for a period of 20 years. The extension of the License and its useful economic life has resulted in a substantial reduction in the annual amortization charge compared to previous years.

12.2 The net book value of software includes software under development amounting to QR 129.5 million (2018: QR 37.2 million) which are not amortised.

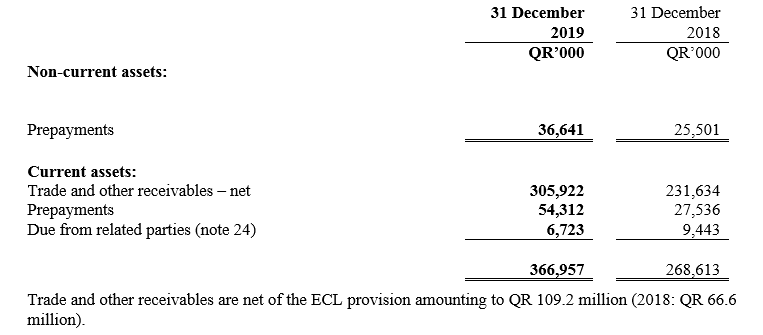

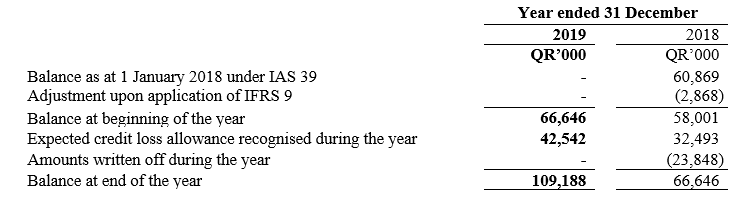

13 TRADE AND OTHER RECEIVABLES

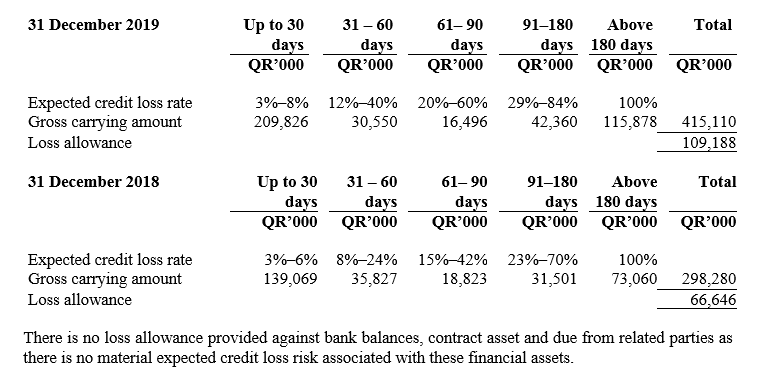

No interest is charged on outstanding trade receivables. The Group measures the loss allowance for trade receivables at an amount equal to lifetime ECL. The expected credit losses on trade receivables are estimated using a provision matrix by reference to past default experience of the debtor and an analysis of the debtor’s current financial position, adjusted for factors that are specific to the debtors, general economic conditions of the industry in which the debtors operate and an assessment of both the current as well as the forecast direction of conditions at the reporting date. The Group has recognised a loss allowance of 100% against all non-government receivables over 180 days past due because historical experience has indicated that these receivables are generally not recoverable.

The Group writes off a trade receivable when there is information indicating that the debtor is in severe financial difficulty and there is no realistic prospect of recovery, e.g. when the debtor has been placed under liquidation or has entered into bankruptcy proceedings, or when the trade receivables are over two years past due, whichever occurs earlier.

Measurement of the expected credit loss allowance

The measurement of the expected credit loss allowance for financial assets measured at amortised cost is an area that requires the use of complex models and significant assumptions about future economic conditions and credit behaviour (e.g. the likelihood of customers defaulting and the resulting losses).

Elements of the ECL models that are considered accounting judgments and estimates include:

- Development of ECL models, including the various formulas and choice of inputs

- Determining the criteria if there has been a significant increase in credit risk, therefore allowances for financial assets should be measured on a lifetime ECL basis and the qualitative assessment;

- The segmentation of financial assets when their ECL is assessed on a collective basis; and

- Determination of associations between macroeconomic scenarios and, economic inputs, and their effect on probability of default (PDs), exposure at default (EADs) and loss given default (LGDs)

Selection of forward-looking macroeconomic scenarios and their probability weightings, to derive the economic inputs into the ECL models. It has been the Group’s policy to regularly review its models in the context of actual loss experience and adjust when necessary.

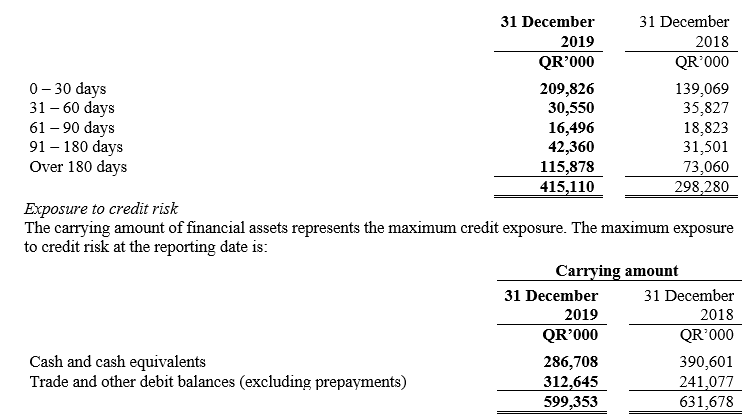

The following table details the risk profile of trade receivables based on the Group’s provision matrix.

The following table shows the movement in expected credit losses that has been recognised for trade and other receivables:

14 CONTRACT ASSETS

Amounts relating to contract assets are balances earned but not yet billed to the customers. Any amount previously recognised as a contract asset is reclassified to trade receivables at the point at which it is invoiced to the customer.

Payment for telecommunication services is not due from the customer until the bill run is complete and therefore a contract asset is recognised over the period in which the telecommunication services are performed to represent the Group’s right to consideration for the services transferred to date.

There were no impairment losses recognised on any contract asset in the reporting period (2018: QR Nil).The management of the Group always measure the loss allowance on amounts due from customers at an amount equal to lifetime ECL, taking into account the historical default experience and the future prospects.

15 CONTRACT COSTS

This represents customer acquisition cost incurred by the Group. The amount is classified as a current asset and amortised over customers’ lock in period.

16 INVENTORIES

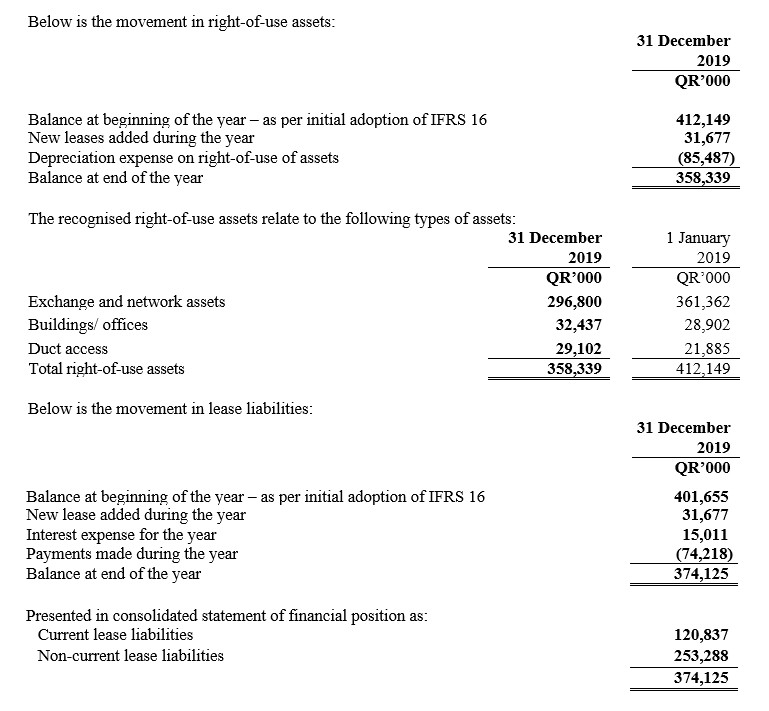

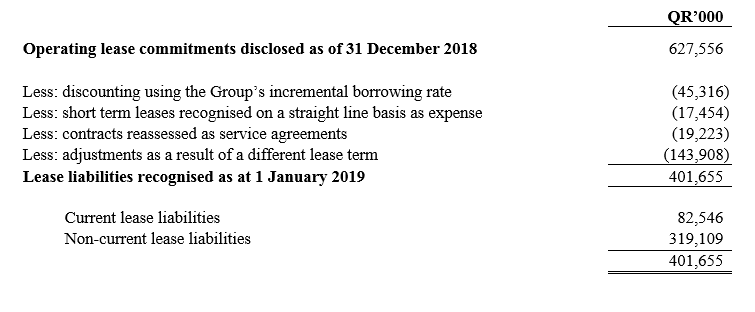

17 LEASES AND RIGHT-OF-USE ASSETS

The Group leases various offices, cell sites, warehouses, ducts, retail stores and equipment. Rental contracts are typically for fixed periods of 5-10 years but may have extension options.

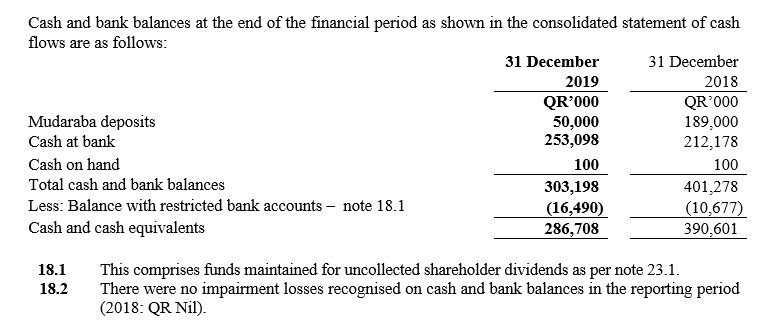

18 CASH AND BANK BALANCES

The Group leases various offices, cell sites, warehouses, ducts, retail stores and equipment. Rental contracts are typically for fixed periods of 5-10 years but may have extension options.

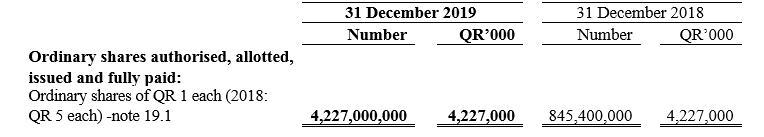

19 SHARE CAPITAL

19.1 In line with instructions from Qatar Financial Markets Authority (QFMA), the Company’s Extraordinary General Assembly on 4 March 2019 approved a 5 for 1 share split i.e. 5 new shares with a par value of QR 1 each were issued in exchange for 1 old share with a par value of QR 5 each. This has led to an increase in the number of authorized, allotted, issued and fully paid up shares from 845,400,000 to 4,227,000,000. The listing of the new shares on Qatar Exchange was effective from July 04, 2019. There has been no change to the share capital of the Company as a result of the share split.

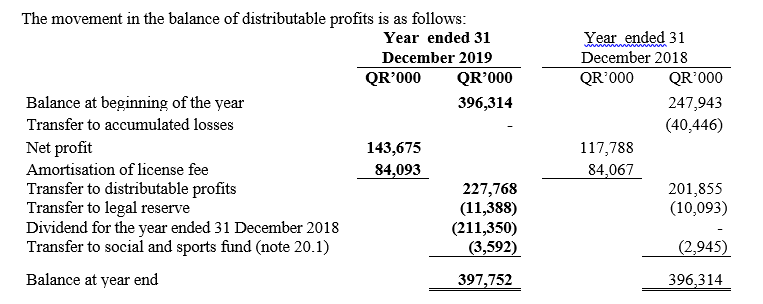

20 LEGAL RESERVE AND DISTRIBUTABLE PROFITS

The Company was incorporated under Article 68 of the Qatar Commercial Companies’ Law No. 5 of 2002. This law was subsequently replaced by Qatar Commercial Companies Law No.11 of 2015.

The Articles of Association of the Company were amended after the introduction of Qatar Commercial Companies Law No.11 of 2015 and subsequently approved by the Ministry of Economy and Commerce.

The legal reserve and distributable profits of the Company are determined in line with its Article of Association.

Legal reserve:

The excess of issuance fees collected over the issuance cost during the initial public offering of the ordinary shares has been transferred to the legal reserve as required by Article 154 of Qatar Commercial Companies Law No. 5 of 2002. Further, as per the Articles of Association of the Company, 5% of annual distributable profits should be transferred to a separate legal reserve. The General Assembly may discontinue this deduction if the legal reserve reaches 10% of the paid up capital.

Distributable profits:

As per the Articles of Association of the Company, distributable profits are defined as the reported net profit/loss for the financial year plus amortisation of license fees for the year. Undistributed profits are carried forward and are available for distribution in future periods.

(b) Measurement of operating segment profit or loss, assets and liabilities

The CODM reviews financial information prepared based on IFRS adjusted to meet the requirements of internal reporting. Such financial information does not significantly differ from that presented in these consolidated financial statements.

20.1 Social and sports fund

According to Qatari Law No. 13 for the year 2008 and the related clarifications issued in January 2010, the Company is required to contribute 2.5% of its annual net profits to the State Social and Sports Fund. The clarification relating to Law No. 13 requires the payable amount to be recognised as a distribution of income in the consolidated statement of changes in equity.

21 LOANS AND BORROWINGS

21.1 Wakala Contract

The Group entered into a Sharia compliant wakala contract with Vodafone Finance Limited for USD 330 million on 18 November 2014 (the “Wakala Contract”). The facility had a tenure of five years at an agreed profit share based on six month LIBOR plus a margin of 0.75%. The facility was availed on 15 December 2014. The facility was guaranteed by Qatar Foundation for Education, Science and Community Development.

The wakala investment was renewed on 31 March and 30 September every year to reset the profit rates without cash settlement. The accumulated profits were then reinvested by the Muwakkil. The Wakala contract was due for repayment five years from the origination date i.e. 18 November 2014. Accordingly, this liability was fully settled during the year.

21.2 Term Finance Loan

The Group entered into a Facility Agreement with a local bank for QR 820 million on 29 October 2019 (“the facility”) at an agreed interest rate of QMRL less 25 BPs. The facility of QR 820 million was availed on 12 November 2019 for a term of five years. The facility is repayable in 16 equal quarterly installments of QR 51.25 million each starting February 2021. The facility is secured against general assignment agreement. Interest of QR 5.3 million was incurred during the year on the facility.

The Group also secured a long-term financing facility of QR 911 million on 27 May 2018 from a local bank. As of reporting date, no amounts were drawn by the Group against this long- term financing facility.

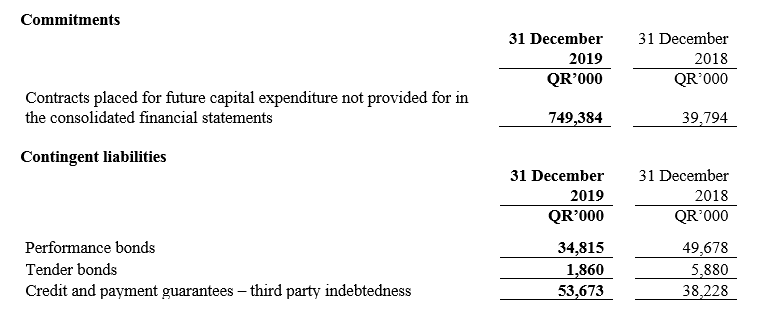

22 PROVISIONS

22.1 Asset retirement obligations

In the course of the Group’s activities, a number of sites and other assets are utilised which are expected to have costs associated with decommissioning. The associated cash outflows are substantially expected to occur at the dates of exit of the assets to which they relate, which are long term in nature.

During the year, the Group recorded an additional provision of QR 16.1 million (2018: QR 9.8 million) on account of new sites added and unwinding of discount for liability. An amount of QR 11.8 million (2018: QR 6.3 million) was capitalized as additions of property, plant and equipment which has been excluded from the purchase of property, plant, and equipment in consolidated statement of cash flows.

22.2 Employees’ end of service benefits

23 TRADE AND OTHER PAYABLES

23.1 Dividend payable

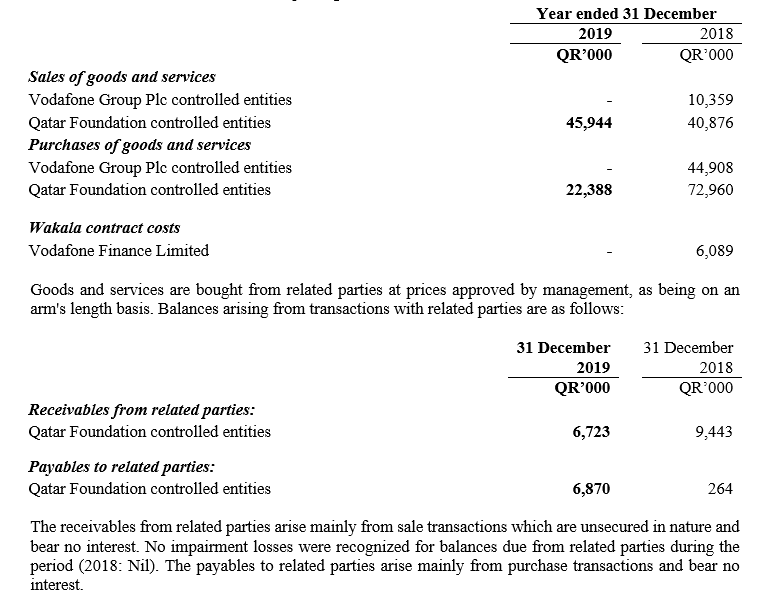

24 RELATED PARTY TRANSACTIONS

Related parties represent the shareholders, directors and key management personnel of the Group and companies controlled, jointly controlled or significantly influenced by those parties.

During the year 2018, there was a change in the ultimate ownership of the Group, as a result of which Vodafone Group Plc controlled entities are no longer related parties of the Group as of reporting date. For that reason, all amounts payable to/receivable from Vodafone Group Plc controlled entities were reclassified as trade payables, trade receivables or other third party liabilities based on their nature.

For the purpose of faithful representation of events and transactions, presented below is the following:

- Transactions with Vodafone Group Plc controlled entities until the date of change in the related party status.

- Transactions with Qatar Foundation controlled entities after the date of change in the related party status and the balances as of reporting date

Compensation of key management personnel

Key management personnel include the Board of Directors, Managing Director, Chief Executive Officer (CEO) and the executives who directly report to the CEO. Compensation of key management personnel are as follows:

25 FINANCIAL INSTRUMENTS AND RISK MANAGEMENT

Financial instruments

Significant accounting policies

Details of significant policies and methods adopted including the criteria for recognition for the basis of measurement in respect of each class of financial assets and financial liabilities are disclosed in note 3 to these consolidated financial statements.

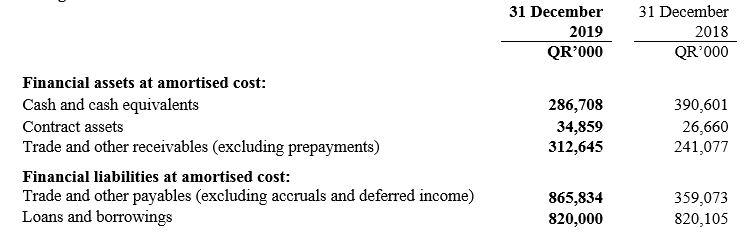

Categories of financial instruments

Fair value of financial instruments

Fair value is the price that would be received to sell an asset or paid to transfer a liability in an orderly transaction between market participants at the measurement date, regardless of whether that price is directly observable or estimated using another valuation technique. In estimating the fair value of an asset or a liability, the Group takes into account the characteristics of the asset or liability if market participants would take those characteristics into account when pricing the asset or liability at the measurement date.

The fair values of financial assets and financial liabilities are determined as follows:

- The fair values of financial assets and financial liabilities with standard terms and conditions and traded on active liquid markets are determined with reference to quoted market bid prices at the close of the business on the reporting date.

- The fair values of other financial assets and financial liabilities are determined in accordance with generally accepted pricing models based on discounted cash flow analysis using prices from observable current market transactions and dealer quotes for similar instruments.

Fair value measurements are analysed by levels in the fair value hierarchy as follows:

- Level 1 – Quoted prices (unadjusted) in active markets for identical assets or liabilities.

- Level 2 – Inputs other than quoted prices included within level 1 that are observable for the asset or liability, either directly (that is, as prices) or indirectly (that is, derived from prices).

- Level 3 – Inputs for the asset or liability that are not based on observable market data (that is, unobserved inputs)

Management considers that the carrying amounts of financial assets and financial liabilities recognised at amortised cost in the consolidated financial statements approximate their fair values due to the short maturity period.

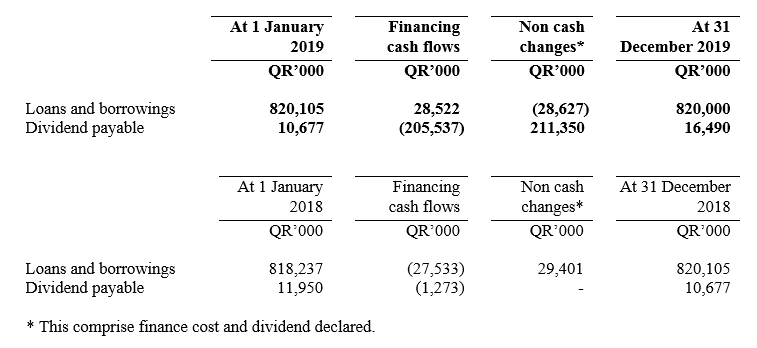

Reconciliation of liabilities arising from financing activities

The below table details changes in the Group’s liabilities arising from financing activities, including both cash and non-cash changes:

Financial Risk Management

Foreign currency risk management

The Group undertakes certain transactions denominated in foreign currencies and hence exposed to risks on exchange rate fluctuations. The Group uses currency forwards to mitigate its financial risks on foreign exchange rates. The use of financial derivatives is governed by the Group’s policies, which provide written principles on the use of financial derivatives consistent with the Group’s risk management strategy. The Group does not use derivative financial instruments for speculative purposes.

Majority of foreign currency receivable/payable balances are in US$ which is pegged against QR. Therefore, these receivable/payable balances are not exposed to foreign currency exchange rate fluctuation risk. The Group has an insignificant amount of receivable/payable balances in Euro and other currencies where effect of any 10% increase/decrease in foreign exchange rates is expected to be equal and opposite to QR 0.8 million (2018 QR 0.8 million).

Interest rate risk management

The Group is liable to pay interest on Term Finance Loan facility, which is aggregate of the applicable margin and QMR-L. Every one percent rise or fall in QMR-L would increase or reduce the total profit of the Group for the financial year by QR 1.12 million (2018: QR 8.3 million for profit rate on Wakala Contract).

Credit risk management

Credit risk refers to the risk that the counterparty will default on its contractual obligations resulting in financial loss to the Group. The Group’s exposure and the creditworthiness of its counterparties are continuously monitored and the aggregate value of transactions concluded is spread amongst approved counterparties. Credit exposure is controlled by counterparty limits that are reviewed and approved by management.

Furthermore, the Group reviews the recoverable amount of each trade debt and debt investment on an individual basis at the end of the reporting period to ensure that adequate loss allowance is made for irrecoverable amounts. In this regard, the directors of the Group consider that the Group’s credit risk is significantly reduced. Trade receivables consist of a large number of customers. Ongoing credit evaluation is performed on the financial condition of accounts receivable.

The Group does not have significant credit risk exposure to any single counterparty or any group of counterparties having similar characteristics. The Group defines counterparties as having similar characteristics if they are related entities.

The credit risk on liquid funds is limited because the counterparties are banks with high credit-ratings assigned by international credit-rating agencies.

Movement in provision for expected credit losses account is presented in note 13. The following table presents ageing of trade receivables (gross):

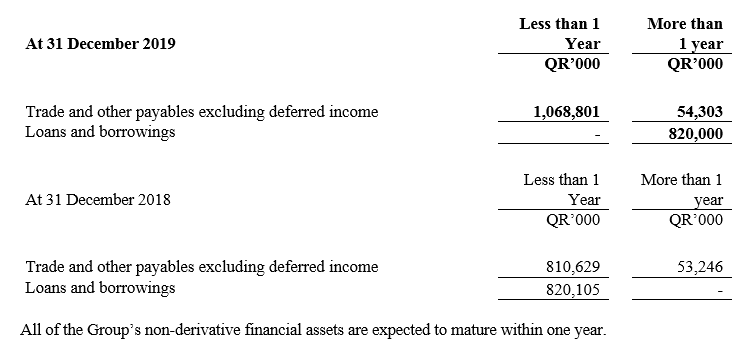

Liquidity risk management

Liquidity risk is the risk that the Group will not be able to meet its financial obligations as they fall due. The Group’s approach to managing liquidity is to ensure, as far as possible, that it will always have sufficient liquidity to meet its liabilities when due, under both normal and stressed conditions, without incurring unacceptable losses or risking damage to the Group’s reputation.

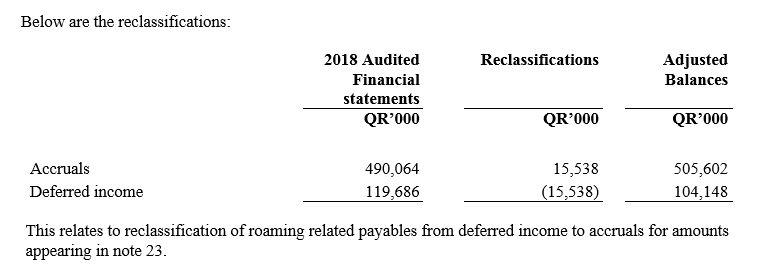

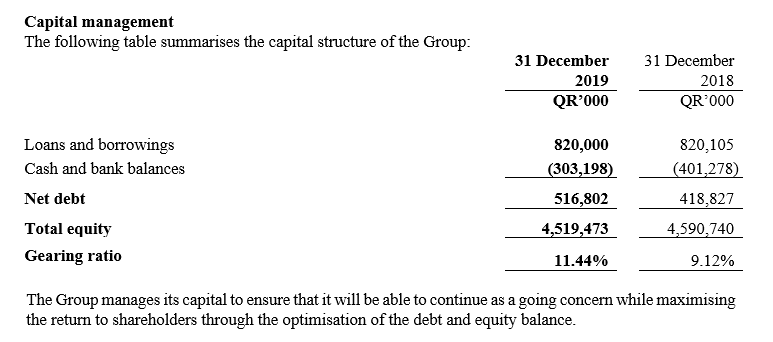

The Group manages liquidity risk by maintaining adequate reserves and adequate loans and borrowings, by continuously monitoring forecast and actual cash flows and matching the maturity profiles of financial assets and liabilities.